DAC’s ₹79,000 Crore Tri-Service Boost: Unpacking the Game-Changers for India’s Maritime and Border Edge

In a pivotal move underscoring India’s accelerated push for military modernization, the Defence Acquisition Council (DAC), chaired by Raksha Mantri Rajnath Singh, greenlit capital acquisitions worth ₹79,000 crore on October 23, 2025. This tranche—spanning the Army, Navy, and Air Force—bolsters tri-service integration amid escalating LAC tensions and Indo-Pacific maritime challenges. With 51% of the FY 2025-26 capital outlay already utilized by September, these approvals signal a strategic pivot toward indigenous platforms, enhancing deterrence without over-reliance on imports.

Army Enhancements: Fortifying Border Mobility

The Army’s share focuses on tracked lethality and intelligence superiority. The Nag Missile System (Tracked) Mk-II (NAMIS) will equip mechanized infantry with fire-and-forget anti-tank capabilities, neutralizing enemy armor up to 4 km—critical for LAC skirmishes. Paired with the Ground Based Mobile ELINT System (GBMES), which intercepts enemy radar emissions in real-time, and High Mobility Vehicles (HMVs) with material-handling cranes for rapid logistics, these assets address terrain-specific vulnerabilities exposed in 2020 Galwan clashes.

| System | Role | Indigenous Content | Estimated Impact |

|---|---|---|---|

| Nag Mk-II (NAMIS) | Anti-tank strikes | 85% | 200+ units for border corps |

| GBMES | Electronic intel | 90% | Real-time threat mapping |

| HMVs w/ Cranes | Logistics mobility | 75% | Enhanced supply chain in high-altitude |

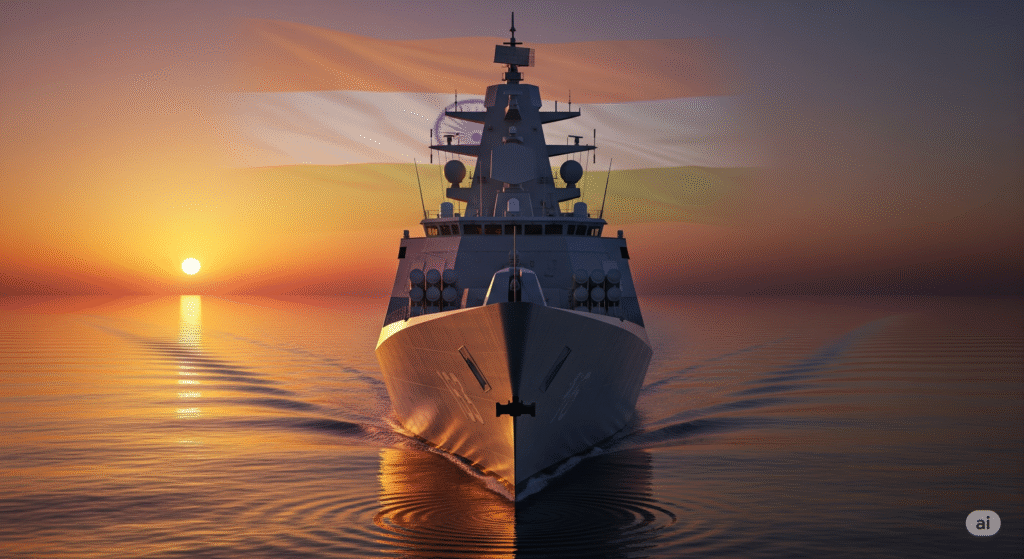

Navy’s Maritime Leap: Amphibious and Sub-Surface Dominance

The Navy emerges as a prime beneficiary, with Landing Platform Docks (LPDs) set to revolutionize amphibious ops. These 40,000-tonne behemoths—capable of deploying 1,000 troops, helicopters, and landing craft—will enable joint HADR missions and rapid island seizures in the Andamans. Complementing this are Advanced Light Weight Torpedoes (ALWTs), DRDO’s NSTL-developed submarine hunters targeting nuclear and midget subs up to 40 km, and 30mm NSGs for anti-piracy patrols. Amid China’s Yuan-class expansions, these fortify the Arabian Sea chokepoints.

Strategic Implications: Toward 2030 Force Multipliers

These procurements align with the ‘Year of Reforms,’ projecting a 25% capability surge by 2030. Budget-wise, R&D allocation (up 12.4%) ensures 70% indigenization, curbing import dependencies amid CAATSA risks. Compared to China’s $230B defence spend, India’s ₹6.81 lakh crore outlay emphasizes quality over quantity—think networked LPD strikes vs. sheer numbers. Challenges persist: supply chain delays could push timelines to 2028, but MSME integrations via iDEX mitigate this.

“This isn’t just procurement; it’s sovereignty in steel and silicon.” — Raksha Mantri Rajnath Singh