Beyond Big Defence: Private Industry & MSMEs Powering India’s Military Supply Chain in 2025

India’s “Make in India” defence story isn’t just being written by giants like DRDO or HAL. In 2025, a thriving network of MSMEs, startups, and private-sector pioneers is powering the gears of India’s nextgen arsenal—supplying components, electronics, software, advanced materials, and even exporting to key strategic markets. As government policies, procurement models, and accelerator programs evolve, these agile players are driving innovation, resilience, and international reach for India’s military industry.

The Rise of Defence MSMEs

For decades, Indian defence supply was concentrated among legacy state-owned enterprises. But visionary reforms—the Defence Production and Export Promotion Policy (DPEPP), offset policy changes, and new “Make-II” and “Make-III” categories—created the ideal launchpad for private industry. By 2025, over 12,000 MSMEs are registered as official defence suppliers, with hundreds competing for orders in everything from microelectronics to smart munitions.

Breakout Success Stories: India’s Private Defence Champions

- Tata Advanced Systems & Mahindra Defence: JV partnerships, aerostructures for C-130J, armoured vehicles, export radar systems

- Bharat Forge & Kalyani Group: Artillery, tank, engine precision components—export to Middle East, South America

- AXISCADES Engineering: Digital twin work, missile/aircraft/naval platforms for MoD and global primes

- SMPP Pvt Ltd.: Indigenous bulletproof jacket exports, large MoD orders

- Solar Industries India: Ammunition, rocket engines, smart loitering munitions—40+ export nations

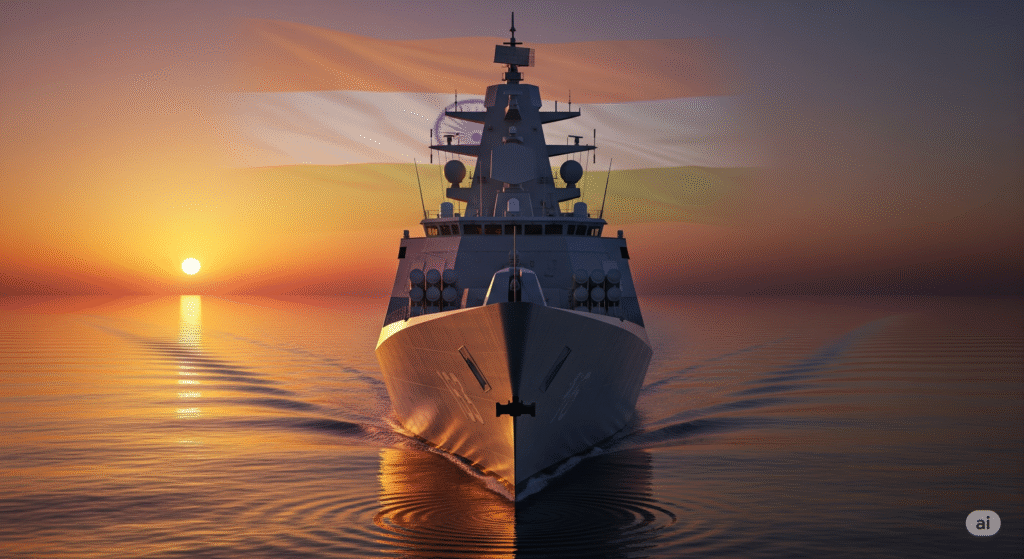

- Micronel Global Engineers & Data Patterns: Avionics, radars, missile electronics—core to Akash, Tejas, naval ships

How Government Accelerates MSME Growth and Exports

- iDEX and ADITI Programs: 130+ MSMEs/startups funded, rapid demo-to-induction, partnership with PSUs.

- Export Policy Liberalization: Subsystems, sensors permitted, SE Asia, Gulf, Africa main markets.

- Offset Reforms & Vendor Dev: Defence corridors, cluster pooling, shared certification, easier tendering.

Real-World Impact: From Border Ops to Battle Lab

- New armor for Army’s IFVs and Zorawar tanks

- Indigenous electronics for Su-30MKI, LCA Tejas, Project Kusha

- Secure radios, mesh networking, soldier terminals for Army

- Aerospace composites, IR optics, loitering munitions in live ops

Export Success: Indian Defence Goes Global

- SMPP: Jackets for Africa, Data Patterns: Fire control SE Asia, Solar Industries: Smart ammo Middle East

- $3.5B+ exports in 2025, up 40% vs 2023

- Embassy/export cells, digital B2B boosting MSME global access

Defence Industry Accelerators & Cluster Stories

- iCreate, T-Hub, Forge: Tech incubators/accelerators—funding, pilot orders, mentorship

- Defence corridors: Plug-and-play factories, shared certification, reduced entry barriers

What’s Next: Innovation, Collaboration, and Global Scale

- 1/3rd indigenization by MSMEs/startups by 2030

- Talent flow: ex-servicemen, global engineers, new STEM hires

- Clearer exports, state support: Secure comms, drone autonomy, sensor fusion, rapid prototyping for future wars

Conclusion: Powering Sovereignty from the Bottom Up

India’s military strength in 2025 increasingly comes from its supply chain’s depth, agility, and innovation. MSMEs and private industry output is set to make India’s dream of strategic autonomy, technological leadership, and export success a real and sustainable reality.