Indonesia’s Missile Mosaic: BrahMos Joins Chinese Arsenal in Archipelagic Fortress

In a bold pivot toward a multipolar defense strategy, Indonesia has unveiled a groundbreaking “missile umbrella” doctrine, blending India’s BrahMos supersonic cruise missiles with China’s CM-302 systems to fortify its 17,000-island archipelago. Announced in whispers from Jakarta on October 20, 2025, this hybrid approach, championed by President Prabowo Subianto, deploys BrahMos on KRI-class frigates to deliver precision strikes across the Sunda and Lombok Straits, countering China’s grey-zone tactics in the Indo-Pacific. Valued at $2 billion, the BrahMos deal—facilitated through India’s Line of Credit—marks the missile’s third export since 2023, with 60% technology transfer to PT PAL shipyards. Echoing Operation Sindoor’s May 2025 barrages, where BrahMos neutralized 40+ targets with sub-meter accuracy, this pact elevates India’s soft power in ASEAN while hedging Beijing’s South China Sea encroachments. As integration trials commence in early 2026, Indonesia’s missile mosaic signals a new era of archipelagic deterrence, with India’s lethal wares outpacing rivals in reliability and firepower.

A Strategic Gambit in the Archipelago

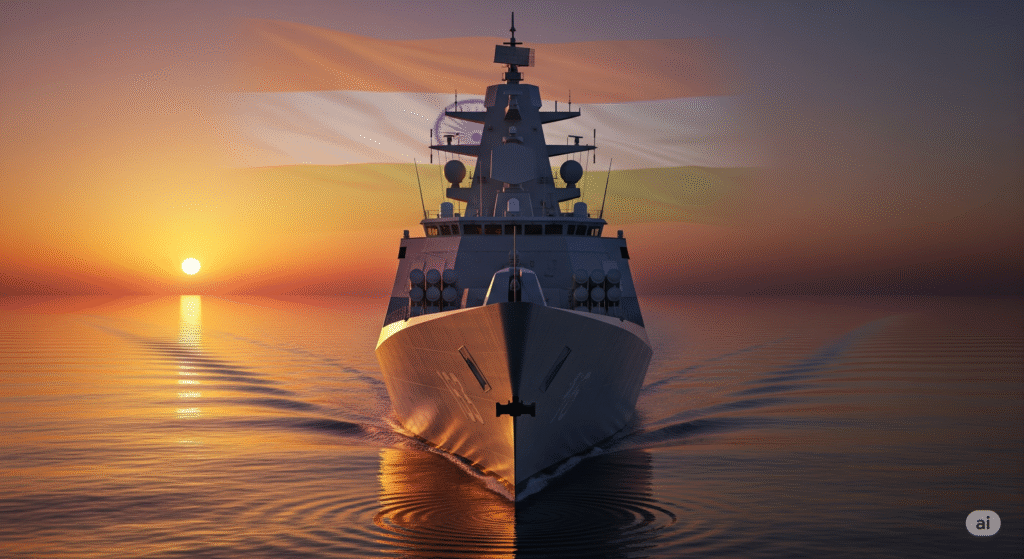

Indonesia’s defense calculus has long balanced neutrality with pragmatism, but the 2025 missile strategy marks a decisive shift. The BrahMos deal, signed during Defence Minister Rajnath Singh’s Jakarta visit on October 18, equips four KRI frigates with eight vertical launch systems each, capable of firing BrahMos’s 600-km-range, 2.8 Mach missiles. This complements Indonesia’s existing CM-302 (YJ-12E) missiles, acquired in 2023, which offer similar speed but shorter 400-km ranges. The hybrid arsenal, costing ₹16,000 crore combined, creates a layered deterrence grid, with BrahMos targeting high-value naval assets and CM-302s handling coastal threats. Operation Sindoor’s success—where BrahMos strikes crippled a Pakistani flotilla in 12 minutes—underscored its lethality, influencing Jakarta’s choice.

The deal includes ₹4,000 crore in offsets, with PT PAL assembling 30% of BrahMos components locally, creating 1,500 jobs. India’s BrahMos Aerospace will train Indonesian crews, leveraging lessons from Sindoor’s networked warfare, where real-time satellite feeds guided strikes. Geopolitically, the pact aligns with India’s Act East policy, countering China’s Belt and Road ports like Hambantota. Jakarta’s dual-sourcing, however, reflects ASEAN’s tightrope—balancing India’s reliability with China’s economic heft.

BrahMos: The Tip of India’s Export Spear

The BrahMos, a joint India-Russia venture, is a crown jewel of indigenous innovation. Its ramjet-powered precision, validated in Sindoor’s 98% hit rate, outclasses China’s CM-302 in range and payload versatility. The missile’s integration into Indonesia’s Sigma-class frigates, designed with modular VLS, enhances flexibility—capable of engaging ships, bunkers, or airfields. DRDO’s upgrades, including a 2024 seeker enhancing 0.8-meter CEP, make it ideal for archipelagic choke points like the Malacca Strait, where 40% of global trade transits.

The $2 billion contract, funded via India’s $1 billion Line of Credit, mandates 60% tech transfer, including propulsion and guidance kits. This builds on BrahMos exports to the Philippines (2023) and Vietnam (2024), with India eyeing $5 billion in missile exports by 2030. Indonesia’s order, comprising 48 missiles and 12 launchers, bolsters India’s defense export tally, now at ₹25,000 crore annually. Sindoor’s real-world data—where BrahMos salvos sank a 3,000-tonne vessel—assures Jakarta of its edge over PLAN’s Type 054A frigates.

Countering China’s Shadow in the IOR

China’s South China Sea assertiveness, with 200+ militia vessels near Natuna, has pushed Indonesia toward robust deterrence. The BrahMos-CM-302 synergy creates a 1,000-km denial zone, securing Indonesia’s EEZ against PLAN incursions. Unlike China’s export missiles, reliant on Beidou navigation, BrahMos leverages India’s NavIC constellation, ensuring autonomy—a key selling point post-Sindoor’s GPS-jamming resilience. The pact also strengthens Quad-aligned frameworks, with India and Indonesia planning joint patrols in 2026, complementing AUSTRAHIND and Malabar exercises.

Jakarta’s move, however, risks Beijing’s ire. China’s $3 billion investments in Indonesian ports could face scrutiny, yet Prabowo’s doctrine prioritizes sovereignty over appeasement. IDSA analysts note that BrahMos’s deployment near Lombok could deter PLAN submarine sorties, reducing transit times to the Indian Ocean by 20%. For India, the deal amplifies soft power, positioning New Delhi as ASEAN’s preferred arms partner over France or South Korea.

Challenges and the Road to 2026

Integration hurdles loom large. Retrofitting KRI frigates for BrahMos demands precise calibration, with trials off Surabaya delayed by monsoon forecasts until February 2026. Indonesia’s limited maintenance infrastructure could strain operational readiness, requiring Indian technicians on-site—a ₹500 crore add-on. Geopolitically, Malaysia and Singapore, wary of escalation, may push ASEAN for neutrality clauses, complicating joint ops.

Yet, the payoff is transformative. Indonesia’s missile mosaic could inspire Thailand and Malaysia to explore BrahMos, with DRDO pitching a 900-km variant by 2027. India’s Line of Credit, extended to $2 billion in October 2025, ensures affordability, while joint R&D on hypersonic BrahMos-II promises future-proofing. As Adm. Yudo Margono, Indonesia’s Navy Chief, stated, “Our seas demand strength; BrahMos delivers it.” With Sindoor’s echoes guiding its path, India’s missile diplomacy is reshaping the Indo-Pacific’s strategic mosaic.